ExxonMobil and CP Chem prepare to open crackers; PTT, Daelim sign cracker agreement in Ohio

Our pick of the latest petrochemical news you need to know

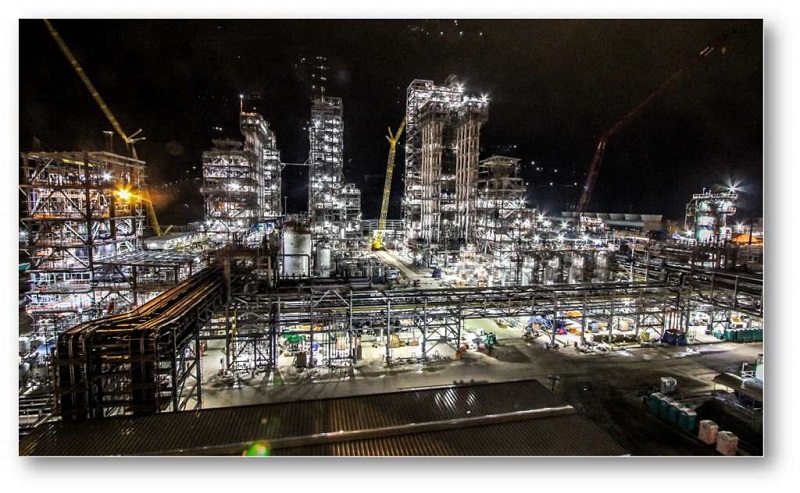

ExxonMobil Baytown cracker complete and Q2 start-up expected

ExxonMobil said its new 1.5 million tonne/year ethane cracker at its Baytown, Texas complex is mechanically complete and expected to start up during the second quarter of 2018.

The company also said commissioning, which involves testing systems and running initial feedstocks through the cracker, was "progressing well."

The cracker's startup was delayed from the fourth quarter of 2017 to 2018 after Hurricane Harvey caused massive flooding to the area in August 2017.

ExxonMobil started the construction of the ethane cracker in 2014, which generated at least 10,000 construction jobs in the area along with 4,000 related jobs in nearby Houston. Once operational, it is expected to support 350 new permanent positions at the Baytown complex, $870 million a year in regional economic activity and $90 million per year in local tax revenues.

To support the industry’s need for skilled workers as part of this growth, ExxonMobil has contributed $2 million over the last five years to the Community College Petrochemical Initiative, a training program offered by nine Houston-area community colleges to provide technical skills to high school graduates, returning military veterans and others.

“With the completion of the project in Baytown, we are on the verge of fully realizing one of ExxonMobil’s most significant U.S. Gulf Coast investments,” said John Verity, president of ExxonMobil Chemical Company. “Our new ethane cracker will allow us to economically meet rapidly growing demand for high-performance polyethylene products around the world while continuing to sustain economic development and create jobs for decades to come.”

The Baytown chemical expansion project is a key component of ExxonMobil’s previously announced Growing the Gulf initiative. In addition to the ethane cracker in Baytown, ExxonMobil and SABIC are proposing to build a jointly owned petrochemical complex in San Patricio County, Texas, that would include a 1.8 million ton-per-year ethane cracker – the largest capacity of any ethane cracker built to date.

Most of ExxonMobil’s planned new chemical capacity investment in the Gulf region is focused on supplying export markets such as Asia with high-demand products, which will contribute to strengthening the United States’ balance of trade.

Recent changes in the U.S. corporate tax rate also create an environment for increased future capital investments in projects such as these, and will further enhance the company’s competitiveness in global markets.

“The U.S. chemical industry is rapidly expanding along the Gulf Coast due to abundant supplies of domestically produced natural gas, as demonstrated by the investments ExxonMobil alone is making,” Verity said. “This expansion will not only increase the nation’s existing manufacturing and export capacity, but also further stimulate economic growth and create thousands of full-time jobs.”

CP Chem prepares to open steam cracker in Q1

The Chevron Phillips Chemical cracker will start up during the first quarter of this year and ramp up to full production in the second quarter, Phillips 66 CEO Greg Garland said during quarterly earnings calls.

Image: Chevron Phillips

The cracker’s start up was pushed from year-end 2017 to the the first quarter of 2018 after flooding from Hurricane Harvey last August.

Chevron Phillips Chemical announced that its world-scale ethane cracker at Cedar Bayou in Baytown, Texas successfully achieved the major milestone of mechanical completion at the end of December.

The unit is now undergoing a series of rigorous commissioning activities, system checks and final certifications to ensure a safe and reliable start-up, and consistent, on-spec production.

Once operational, the unit is expected to produce at least 1.5 million tonnes/year of product. At peak construction, approximately 5,000 workers were employed on this project, helping to spawn additional economic activity across the region.

“With the mechanical completion of Cedar Bayou’s ethane cracker, we are now on the cusp of completing the most transformative project in our company’s history, or U.S. Gulf petrochemical project,” said Mark Lashier, president and chief executive officer of Chevron Phillips Chemical.

The new ethane cracker will produce product for the company’s ethylene business and feedstock for its ethylene derivatives businesses. The polyethylene (PE) fleet now includes the two new PE units at Old Ocean, Texas, which were also part of the U.S. Gulf Coast petrochemical project. These units started up in September 2017 and play a critical role in Chevron Phillips Chemical’s strategic expansion to meet the growing global demand for PE.

In addition to the cracker and PE units, the company has purchased nearly 3,000 newly built rail cars and constructed a state-of-the-art storage-in-transition facility to ship polyethylene via rail to customers both domestically and to ports for export around the globe.

PTT, Daelim sign cracker agreement in Ohio

Daelim Industrial, South Korean construction and petrochemical company, is to partner with Thailand’s largest petrochemical and refining firm PTT Global Chemical (PTTGC), to set up a petrochemical complex in Ohio.

The news follows the announcement of PPTGC America signing a Memorandum of Understanding with JobsOhio signaling a final investment decision (FID) is likely.

Daelim said it plans to sign an investment agreement with PTTGC’s U.S. subsidiary PTTGC America to construct and jointly operate an ethane cracker, and will invest up to 140 billion won ($130.7 million) in the joint project.

The northeastern part of the U.S. has distinct advantages for becoming a petrochemcial hub. It is home to shale gas reserves and rich in ethane. Its geographic proximity to the U.S. eastern region that takes up 70% of the country’s polyethylene market also could save logistics cost.