Insights from first wave of US downstream projects push changes to second wave management

The surge in U.S supply and exports of key feedstocks crude, propane and ethane drove the first wave of downstream capital investment and resulted in an unprecedented petrochemical construction boom. Lessons on key areas such as technology, data and workforce management are spurring strategic decisions as the U.S. begins a second construction boom, analysts told Petrochemical Update.

The industry can and must learn from the past and leverage technology and data, the workforce and global execution to their advantage during the next big petrochemical construction boom, Keith Ackley, Jacobs Vice President and General Manager Petroleum and Chemicals for Houston and Major Projects said.

Ackley was speaking at the Downstream 2018 conference and exhibition in Galveston, Texas.

Five crackers totaling more than 6 million tonnes/year of ethylene capacity began operations between 2017-2018 along the U.S. Gulf Coast.

The pace of building is not slowing with five more crackers under construction and expected to begin operations in the next few years.

Nearly 12 million tonnes of ethylene capacity will enter the U.S. market before the end of 2021.

Growth indicators

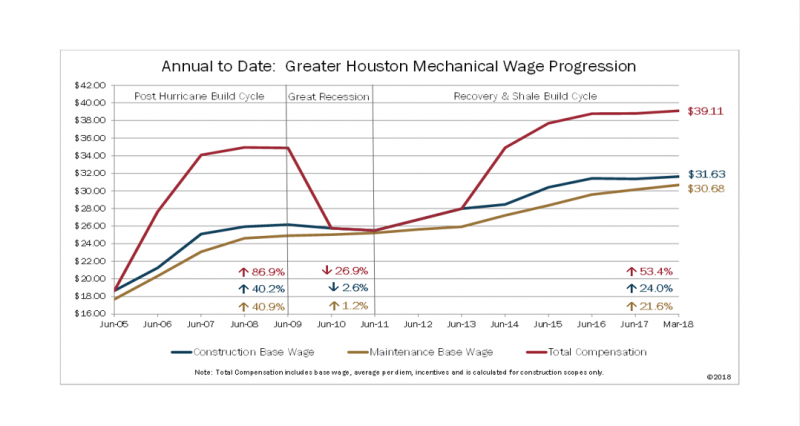

While feedstock growth has been a leading indicator of capital investment, wage progression for the people who build the plants has been a lagging indicator, Ackley said.

“The Houston data shows the growth rate in mechanical wages over the past few years, with the most recent uptick since 2013 highlighted,” Ackley said. “Wages are going up and this is a lagging indicator that we continue to invest. We continue to see announcements and believe there will be significant investment in the near term in the U.S. Gulf Coast and North America in general.”

Looking at an Alpha report, total compensation rates for both construction and maintenance base wages in the Houston, Texas area dropped by more than 25% during the Great Recession in 2010, down from the escalated rates seen in 2008 during the post hurricane rebuild cycle.

Total compensation for end 2017-2018 is now up from the lows seen in the Great Recession by more than 50%, and above the highest levels seen in 2008.

chart: Jacobs

Investment opportunities

Feedstock availability and price are not the only opportunity driving capital investment, Ackley said.

Lower pricing volatility for key feedstock and price indicator crude oil has helped drive decisions. Oil has been in the $60s and 70s/bbl range for some time.

“These investments can be made with crude at that price as long as it is stable. This level gives owners ability to predict return on investment,” Ackley said.

Cost of capital, which is at historic lows, tax reform and a more favorable regulatory environment by state and federal leaders are also creating a positive opportunity for investment.

New entrants are taking advantage of the North American capital market creating a diverse market. Asia, Middle East and Europe are capitalizing on these North American opportunities.

Lessons learned

The first wave of construction projects was unprecedented in terms of growth, and the race to build so many ethylene crackers quickly and simultaneously led to implications for the industry.

According to project data from McKinsey for all large projects in the U.S., 77% of megaprojects are more than 40% late. Not only are large projects late, they are also over budget. 98% of projects are more than 30% over budget. Average overspend is 80%. Average slippage is 20 months behind schedule.

“Short term thinking over the last few decades is what got us here,” Ackley said. “If our industry does not change, the risk is investments could be deferred, projects moved to different geographies and we face further loss of talent.”

The biggest challenges the industry must learn from, Ackley said, include time to market pressure, investment prior to final investment decision, contracting strategy, alignment on true business drivers, competitive market for owner and contractor, inconsistent performance, investment in tools and people and experience gaps.

Workforce

As the industry places more demanding requirements on its capital projects, the complexity of the definition and execution phases is growing exponentially.

“Whether it is the normal drive for cheaper, or faster, or the quest for capital efficiency, the demands we are placing on our project teams are ever-increasing,” Ackley said.

“In the interest of becoming more cost efficient ourselves, we have reduced the capacity and experience levels of our execution teams,” Ackley said. “This contraction is not a new response to the business cycle, but how we react during the inevitable upswing.”

Data

Data and analysis is one key emerging strategy or technology now that Ackley believes will become standard on future projects.

“I feel that we are further along in development of the analysis and information than we are in gathering the fundamental information that drives the analytics,” Ackley said.

The next evolution is how the industry automates or builds in the raw data capturing into its facilities.

“This appears to be the current bottleneck. The challenge we face is the cost and complexity of gathering consistent, quality information is far greater than developing the analytic process to transform it,” Ackley said.

Jacobs has invested heavily in the infrastructure to capture information at its construction job sites.

“Once the foundation of the data infrastructure is in place, not only do we want more information to analyze, we seem to find nearly endless uses for the information to further drive our understanding, our efficiency, and our workforce safety,” Ackley said.

Getting to an Internet of Things (IOT) is the hard part, Ackley explained.

“It appears once you have it, the uses of the data stretch our imaginations. Of course, then our imagination drives the need for more information than originally envisioned,” Ackley said.

Global execution

Leveraging global execution is another thing the industry can do differently.

“In the past decade we have witnessed a step change in the capability and capacity of our global execution partners,” Ackley said.

Whether in professional services, equipment and materials fabrication, or even nearly complete facilities fabrication in modules, the capability and capacity of service and material suppliers in Asia, and Middle East have now caught up with traditional suppliers in North America and Europe.

This new capability, if coupled with new execution models like true Globally Integrated Design, mega modularization, and fabrication yard commissioning, is and will continue to drive the next opportunity in capital efficiency.

For example, project managers should integrate the same best practices on the fabrication yard as on the main project site.

“Regardless of the solution, leverage of technology, information, automation and global execution should all play a part in moving our industry forward, not repeating the boom and bust cycle as we have done in the past,” Ackley said.

By Heather Doyle