Crude exports hit record highs; Shell PA cracker bypasses steel hurdle; Enterprise begins NGL construction in Texas

Our pick of the latest petrochemical news you need to know

Shell PA cracker progresses after steel and aluminum restrictions ease

Shell will continue construction of its multi-billion-dollar ethane cracker in western Pennsylvania after the U.S. Department of Commerce waived restrictions on imported steel from South Korea, Argentina and Brazil.

Pipe spools needed by Shell for the cracker plant have been held by U.S. Customs and Border Protection since early June, unable to move to Pennsylvania since the Trump administration imposed a 25% tariff on steel imports and a 10% tariff on aluminum imports.

U.S. Sen. Pat Toomey sent a letter to the secretary of the Department of Commerce, urging the administration to ease certain quotes on imports, The Pennsylvania Beaver County Times reported.

In his letter, Toomey argued that Shell would potentially have to delay construction on the cracker plant and lay off hundreds of workers because the company couldn’t import the steel it needs to build the plant.

Trump later announced he was easing the quotas. However, the easing of the quota is only applicable to large infrastructure projects that had contracts in place before March 2018.

In his proclamation, Trump acknowledged that large projects “employing thousands of workers may be significantly disrupted or delayed” because of his restrictions on imports. Those projects “were contracted for purchase prior to my decision to adjust imports,” the president said.

Crude oil was the largest U.S. petroleum export in 1H 2018

The U.S. exported 7.3 million barrels/day of crude oil and petroleum products in the first half of 2018, when exports of crude oil and hydrocarbon gas liquids (HGL) set record monthly highs, the U.S. Energy Information Agency (EIA) reported.

Crude oil was the largest U.S. petroleum export in the first half of 2018.

U.S. crude oil exports increased by 787,000 barrels/day, or almost 80% from the first half of 2017 to the first half of 2018 and set a new monthly record of at 2.2 million barrels/day in June.

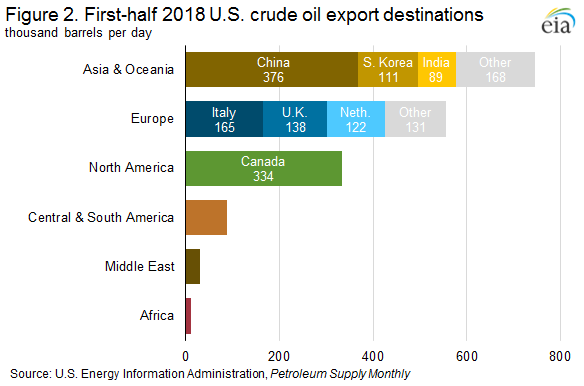

Destinations in Asia and Oceania were the largest recipients of U.S. crude oil exports in the first half of 2018, and U.S. crude oil exports to China more than doubled—increasing by 193,000 barrels/day—from the first half of 2017.

U.S. crude oil exports to South Korea and India also increased significantly during this period, up 81,000 barrels/day and 72,000 barrels/day respectively.

Europe was the second-largest market for U.S. crude oil exports, receiving 555,000 barrels/day in the first half of 2018.

Canada was the only major U.S. crude oil export destination where exports decreased somewhat, down 13,000 barrels/day in the first half of 2018 compared with the same period in 201

Enterprise begins construction of new NGL fractionator in Texas

Enterprise Products Partners has begun construction of a new natural gas liquids (NGL) fractionator adjacent to its Mont Belvieu, Texas complex.

The new unit will have a nameplate capacity of 150,000 barrels/day, giving Enterprise 905,000 barrels/day of fractionation capability in the Mont Belvieu area, and approximately 1.4 million barrels/day companywide. The fractionator is scheduled to begin service in the first quarter of 2020.

“The addition of our newest fractionator will facilitate continued NGL production growth, including from the Permian Basin where NGL volumes are expected to more than double over the next four years,” said A.J. “Jim” Teague, chief executive officer of Enterprise’s general partner.

“This new fractionator will supply NGL products for the expanding petrochemical industry on the U.S. Gulf Coast as well as growing global demand for NGLs,” he added.

The Permian Basin and the Eagle Ford account for approximately 70% of the domestic growth in NGLs, Enterprise said. The new fractionator is supported by long-term customer agreements.

Enterprise is also considering additional projects to move oil out of the Permian basin of West Texas and New Mexico, the biggest U.S. oil patch, as the region’s production has largely exceeded the capacity of its pipelines.

The company is still evaluating converting an existing natural gas liquids pipeline to carry crude to add incremental capacity.

The company’s recently completed Midland–to–Sealy oil pipeline is currently moving volumes at full capacity, about 570,000 barrels per day.

Output growth from the Permian basin, which accounts for a majority of the increase in U.S. production, is expected to stall amid takeaway constraints.

Drilled-but-uncompleted wells (DUCs), especially in the Permian basin, continue to grow in number, an indication of tightness in completion services, labor and trucking, as well as production takeaway concerns, Enterprise said.