US plastics sellers look to optimize export channels through Mexico

U.S. plastics production has taken a dramatic shift amid the First Wave Construction Boom as the U.S becomes a net exporter of resins, and sellers are looking at alternative export options including taking product south of the border, industry executives told Petrochemical Update.

“Over the last previous years, we hear the same thing at all the conferences the concern that U.S. Gulf Ports will struggle to be an outlet for all those resins,” said Camilo Gómez Beltrán, commercial manager for polymers and minerals at Bulkmatic.

While plans are being laid at U.S. ports and railroads to make room for the incoming flux of exports, producers remain concerned about container availability, port congestion, transit times and more. Manufacturers are looking for ways to diversify supply chain options and reduce risk and volatility to ensure products get to customers on time.

“It is a very competitive market and the amount of expansion is indicative of this. With a widening supply chain, avoiding transport interruption is paramount for shippers,” said Jennifer Fussell, Assistant Vice President for Chemical & Petroleum at The Kansas City Southern Railway Company (KCS). “Combine that with congestion and lack of container availability. This creates opportunities to diversify the supply chain.”

Construction Boom

Three of four crackers totaling more than 3 million tonne/year of ethylene capacity have begun operations in 2017 along the U.S. Gulf Coast. These include DowDupont, Occidental/Mexichem and ExxonMobil.

Chevron Phillips has completed its two 500,000 tonne/year PE units at Old Ocean, Texas and is initiating the start-up process of these units, but the $6 billion project's second phase will be delayed due to flooding at the site caused by Hurricane Harvey.

Combined, the U.S. Gulf crackers finishing that first stage of production in 2017/early 2018 will produce a total of 5 million tonnes/year of ethylene capacity. Five more crackers are under construction and expected to begin operations before the end of 2019.

Some 10.3 million tonnes of ethylene capacity will enter the U.S. market before the end of 2019.

Meanwhile, an entirely new petrochemical boom is brewing, this one nicknamed, the “second wave” with key decisions on mega projects being greenlighted at the same rapid pace as the first wave.

Investment in polyethylene (PE) capacity is expected to increase North American PE production to more than 54 billion pounds by 2020. PE production will exceed domestic demand, adding up to 6-9 billion pounds of excess inventory for export through 2020, assuming 75% of the announced projects start up on time.

But PE is not the only resin growing at rapid pace, polystyrene (PS), polyvinyl chloride (PVC) and polypropylene (PP) are also skyrocketing. Analysts predict that eventually nearly half of all resin produced in the U.S. will be exported.

The US-Mexico Petrochemical Export Solution for Plastics

Producers are looking for export options that offer available empty containers, fast turnarounds, short transit times, competitive freight rates, high over-the-road and container weight allowances, as well as options to avoid port congestion and delays.

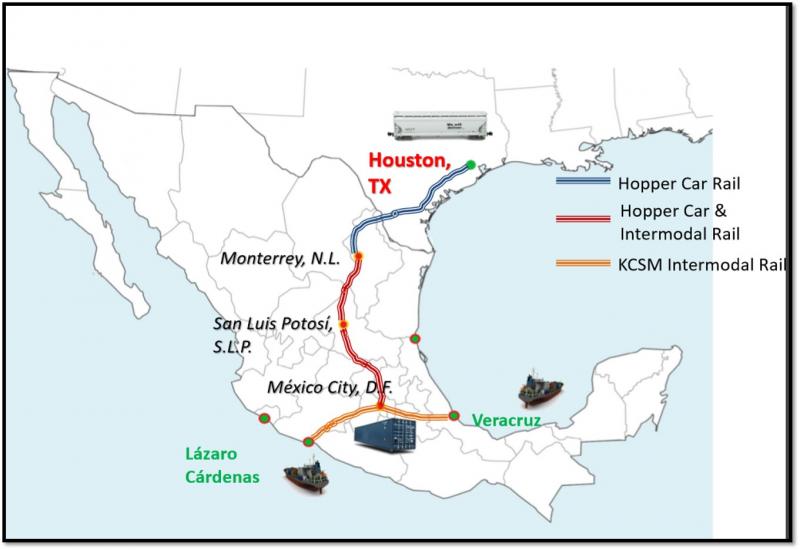

Viable U.S. export options are through Houston; Dallas Forth Worth (DFW) to Long Beach, California; East Coast Packing (Europe), and Bulkmatic de Mexico/KCS Mexico.

Mexican Ports are now being looked at as an alternative to U.S. ports for plastic resins exports using resources through a recent joint venture with KCS and Bulkmatic.

Mexico is a good option for US product because of the availability of packaging facilities, rail infrastructure, containers availability, and port capacity, according to Beltrán.

Image: Bulkmatic

For example, a shipper takes product from the U.S. Gulf plant by rail in bulk and puts it on hopper cars. The hopper cars heads directly to the Bulkmatic terminal in Mexico. Bulkmatic packages the material within the facility boundaries, and then loads shipping containers with the packaged material.

The drayage is sent to an intermodal facility to get loaded on a train. The Intermodal train delivers containers to the port and the port loads the containers on a steamship line. Finally, the steamship arrives at the destination port.

“This is a direct route transfer change from hopper car to bag or super sack, then containers. The product travels less than five miles and it stays in the warehouse until time to ship in containers,” Beltrán said.

Free Trade Zone Import Regime

Shipping products via Mexico means that ownership of the plastics resides in the foreign entity always, without affecting logistics.

“We can avoid duties, taxes on the product you are importing. It is a temporary importation credit because it will go out of Mexico,” Beltrán said.

Bulkmatic facilities operate under a temporary or free trade zone import regime, thus avoiding value added tax and the creation of permanent establishment in Mexico.

“This streamlines the customs process and clears importation duties at customs because the product is now in a Foreign trade zone at a Bulkmatic facility,” Fussell added. “This method protects against excess taxes while the product is waiting to be sent to its end destination.”

Locations and Capacity

This southbound network into Mexico not only has current capacity but is adding capacity for added plastics volume.

Bulkmatic has multiple terminal and warehouse locations along the route to Mexican ports, simplifying the supply chain. This includes 10 terminals in Mexico, 15 terminals total at U.S. Gulf and in Mexico. Intermodal rails quickly connect the product to one of two ports.

Mexico Ports

The Port of Lázaro Cárdenas on the western side of Mexico and Veracruz on the Eastern side both continue to expand.

APM Terminals at the Port of Lazaro began operations in first quarter of 2017 after a $900 million investment in infrastructure and technology.

Today, the terminal has annual capacity of 1.2 million TEU (twenty foot equivalent unit) and at full build out, the terminal will increase capacity to more than 4 million TEU in 2030.

With the first phase of the terminal complete, APM Terminals Lazaro Cardenas covers 49 hectares, with a 750-meter quay and a depth of 16.5 meters, deep enough to accommodate the latest generation of Ultra-Large Container ships.

Meanwhile in Veracruz, the Gulf of Mexico port’s access channel and turning basin is in the process of being dredged, resulting in 13 million cubic meters being removed and reclaimed, which five new terminals will be built on. The new terminals will be able to handle up to 100 million tonnes/year.

“Containers are available, and empty and waiting,” Beltrán said.

By Heather Doyle