US 2018 downstream capital projects, maintenance outlook surges

The US chemical industry’s renaissance continues in 2018 with capital spending expected to rise by more than 6% from 2017 and planned maintenance spend to increase by 38.5% to $1.26 billion, according to the latest data from trade associations.

U.S. chemical manufacturers remain advantaged with access to cheaper and more abundant feedstocks and energy, helping push the number of announced chemical production projects to nearly 320 with a cumulative value of over $185 billion, according to the American Chemistry Council (ACC).

In addition to the new projects, chemical industry capital spending continues to surge, reaching $38 billion in 2017 and accounting for one-half of total construction spending by the manufacturing sector. Capital spending increased 6.0% in 2017, but will grow by 6.3% in 2018 and 6.8% in 2019, reaching $48 billion by 2022, the ACC said.

“Our fundamentals remain incredibly strong and the U.S. remains the destination for chemical investment,” said Kevin Swift, chief economist of ACC, noting that 62% of the $185 billion in announced projects is foreign direct investment.

Capital spending for bulk petrochemical and organic intermediates, along with spending for plastic resins, will dominate, according to the ACC.

Spending for buildings and structures present strong opportunities during this period, beginning with spending for site preparation and utilities and then building and installation taking over. Major process equipment has largely been specified and procured for most projects although delivery will still occur.

Maintenance

Scheduled plant outages, turnarounds and shutdowns increased by 5% in 2017, with the petroleum refining industry seeing the biggest increase, according to Industrial Info Resources (IIR).

Refiners will increase planned maintenance spend by 38.5% to $1.26 billion in 2018, according to IIR. The chemicals-processing sector will see a 4% increase.

“American chemistry is riding a synchronized global upswing,” Swift said. “Manufacturing has turned a corner, business investment is on the rise, and domestic oil and gas production is on the rebound. It all sets the stage for tremendous momentum, expansion, and capital investment,” he added.

Energy and feedstocks

Access to plentiful and affordable natural gas supplies is allowing the United States to capture an increasing share of the global chemical industry investment.

BP Energy Outlook forecasts that the US will become energy self-sufficient in 2023. Natural gas will replace oil as the leading fuel in US energy consumption around 2023 – increasing its share from 31% today to 39% in 2035. And oil’s share of the fuel mix will fall to 29% by 2035, the lowest level on record.

For the first time in 40 years, new construction of refineries in the US in on the horizon. These are smaller in capacity and less complex and they are tailored specifically to feedstock from shale basins in Texas and North Dakota where they are co-located.

“In total, the US is expected to add between 450 Mbpd and 600 Mbpd of new refining capacity by the early 2020s,” says Lee Nichols in a recent Hydrocarbon Processing view of Global Refining Outlook.

The US stands to become the world’s third-largest liquefied natural gas (LNG) exporter by 2020, when it’s expected to ship about 8.3bn cubic feet a day of capacity, or 14% of the world’s share, according to London-based consultant Energy Aspects Ltd.

More than $88 billion in LNG projects are currently planned, being built or in operation across the U.S.

The industry is rapidly responding to the energy renaissance with pipelines and infrastructure to transport refined products to the Gulf Coast or nearby consumers.

Exports

The major oil and gas developments taking place now from the first wave will cause the United States to become a major exporter of petroleum products and shift the entire trajectory of the global energy system over the next few years, according to the U.S. Downstream Capital Projects, Turnaround and Maintenance Market Outlook 2018 produced by Petrochemical Update.

In addition, a second and third wave of investment is on the way. Much of the new production will be exported to customers around the world.

US polyethylene (PE) production will increase to over 54 billion pounds per year by 2020, up from 44 billion pounds as of the end of 2014.

Excess PE production available for export will be 6–9 billion pounds before the end of 2019, assuming all announced projects are built.

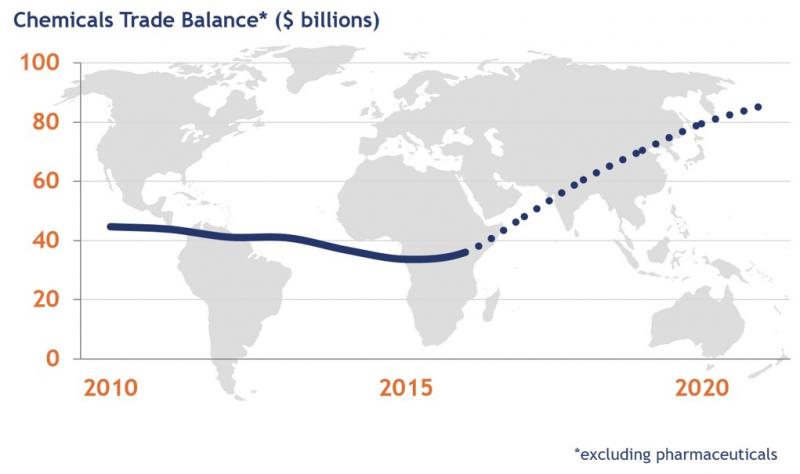

The resulting trend is US chemicals export will continue beyond 2020.

Challenges

Construction costs continue to rise each year. On an annual basis, labor costs are increasing by 1.9% to 2.9% while bulk materials are increasing by 4.7% to 5.7% annually, according to Compass International.

Construction labor in the U.S. Gulf Coast will continue to be in short supply and base wages rates for all trades and per diems for travelers will increase in the first quarter of 2018, according to Compass.

Pipefitters, welders, electricians and instrumentation installers are in the highest demand and shortest supply right now.

Insulators, carpenters, roofers, masons and painters will also be in demand for the next six to twelve months to meet the construction repair effort from hurricane damage. Base rates are expected to increase over the next couple of quarters.

Finding skilled craft workers to build America’s new petrochemical projects will be a challenge in 2018 with craft hours peaking at nearly 164 million hours in 2018, as existing mega-projects near completion.

A long time coming

The United States has now been favorably re-evaluated as an investment location by analysts, and petrochemical producers have announced significant expansions of capacity in the U.S., reversing a decade-long decline in the 2000s.

A new capital spending cycle began in 2010 as chemical manufacturers recovered from the financial crisis and as significant expansions of existing petrochemical capacity emerged due to new supplies of natural gas. The gains to basic olefins capacity during the 2010s are estimated at nearly 40%, according to the ACC.

As a result, chemical industry capital spending in the U.S. surged 67% in the subsequent seven years, reaching $33.8 billion in 2017.

During recent years, chemistry has accounted for one-half of total construction spending by the manufacturing sector.

By 2022, U.S. capital spending by the chemical industry is expected to reach $48 billion, nearly two-and-a-half times the level of spending at the start of this prolonged cycle in 2010.

“The dynamics for sustained capital investment are in place and ACC continues to track the wave of new investment from shale gas,” the ACC said.

By Heather Doyle