US Northeast crackers offer market advantages but higher capex

Total construction costs for a U.S. Northeast cracker project are estimated to be about $197 million higher than for U.S. Gulf Coast projects, however the cost benefits of being close to the feedstock supply and the downstream customers may even this out, according to Petrochemical Update’s US Ethylene Complex Construction Costs Data 2018-2020 report.

Total project costs for a 1.25 mtpa ethane cracker on the Northeast would total about $2.737 billion in a base-case scenario, compared to $2.539 billion on the Gulf Coast, according to Petrochemical Update estimates.

A cracker built in the US Northeast would have higher average labor rates and a higher number of man-hours, as well as higher payroll burdens and indirect costs.

Total construction costs for a 1.25 mtpa cracker in the Northeast are estimated to be about $179.45 million higher than on the Gulf Coast in the current marketplace.

Total labor costs are expected to be about $189.97 million or about 15% higher in the Northeast than in the Gulf Coast.

‘’Building a plant in the Northeast United States using union labor will result in higher wage rates, and additional work hours associated with work rules, and variations in craft productivity, but the poorer productivity now being experienced in the Gulf Coast could even this out,” according to the report.

The highest bulk material costs for a 1.25 mtpa cracker in the Northeast are associated with piping systems, which have the highest materials cost, as well as the highest labor cost.

Of the indirect costs, the majority are associated with labor expenses and contingency, but construction equipment and fuel still carries a significant materials cost. Of the major equipment costs, the biggest are associated with columns c/w trays, followed by compressors, fans and blowers.

Costs increase

Costs for plants in both regions are up nearly 40% from earlier estimates at the start of the construction boom.

“The number of petrochemical projects constructed simultaneously had significant impact in the marketplace. “Time to market” was the primary driver for these projects as everyone wanted to capture the early market opportunity. This resulted in a fast track planning and a construction driven project environment,” said Pathfinder LLC, author of the report.

“This strategy caused many plants to be built with higher cost and schedule delays. Specific impacts resulted from: labor shortages, raw material shortage for things like steel and alloys, immature design with implications in EPC scope and change orders, poor planning during construction which impacted labor productivity and a competitive labor market to hire skilled workers,” Pathfinder continued.

Extreme weather in the US Gulf in 2017 resulted in both a shortage of qualified labor and an increased level of construction activity associated with repair work.

While this impact can be viewed as temporary, a recent Compass International report estimates that the impact over the next six months will range from 5% to 10% for construction support equipment and other indirect costs, and 3.5% to 6.5% increase for craft labor.

“While the Northeast United States is not expected to see this level of increased labor cost, it is clear that there will be impact relative to bulk materials resulting from increased repair activity on a national basis,” Pathfinder said. “This impact is expected to range from 2.5% to 5% for all projects, including those in the Northeast.”

Production Plans

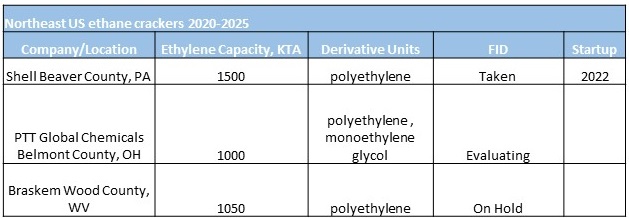

Shell is likely the first of many to plan petrochemical complexes in the Northeast that will use low-cost ethane from shale gas producers in the Marcellus and Utica basins.

Shell Chemical Appalachia has started construction on its chemicals complex comprising an ethylene cracker with polyethylene (PE) derivatives unit, near Pittsburgh, Pennsylvania.

The facility will be built on the banks of the Ohio River in Potter Township, Beaver County, about 30 miles north-west of Pittsburgh.

Because of its close proximity to gas feedstock, the complex, and its customers, will benefit from shorter and more dependable supply chains, compared to supply from the Gulf Coast.

The Shell petrochemical complex in Pennsylvania will be the first major U.S. project of its type to be built outside the Gulf Coast in 20 years.

“As a result of its proximity to gas feedstock, the complex, and its customers, will benefit from shorter and more dependable supply chains, compared to supply from the Gulf Coast,” Shell said. “The location is also ideal because more than 70% of North American polyethylene customers are within a 700-mile radius of Pittsburgh.”

The U.S. subsidiary of PTT Global Chemical (PTTGC America) delayed its final investment decision at the end of 2017 for the possible construction of a world-scale 700,000 tonne/year ethane cracker in Ohio. However, the company said it will provide a ‘significant update that will demonstrate momentum for this project early in 2018.’

Earlier in 2017, the company selected a site. PTTGC America exercised a purchase option on the 168-acre property in Belmont County, Ohio in July.

Brazil’s construction and industrial conglomerate Odebrecht previously explored the construction of a new world scale ethane cracker in West Virginia with Braskem, but withdrew the plans in 2016, citing economic factors.

The project, "Ascent" would have been on the scale of Braskem Idesa in Mexico. The joint venture, which is 75% owned by Braskem, consists of a 1.05 million tonne/year ethane cracker, with three downstream PE units.

Northeast advantage

There are some distinct benefits to locating in the Northeast despite the relatively higher plant construction costs compared to the US Gulf Coast.

The chemical complexes will be located close to ethane supplies and gas processing infrastructure in the heart of the “wet” Marcellus/Utica natural gas liquids production region, which will provide a significant feedstock transport cost advantage versus Gulf Coast crackers, even if ethane prices rise in the next few years.

Ethane transportation costs from the Marcellus/Utica to the Gulf Coast are about 14-20 cents/pound, said Rick Stouffer, energy editor at Kallanish Energy.

Much of the announced ethylene capacity in the Northeast will be used to supply PE derivatives domestically.

The proximity to the end user market is another advantage. More than 70% of North American PE customers are within a 700-mile radius of Pittsburgh.

The U.S. can satisfy domestic demand with a good margin with export capacity to spare to competitively serve European markets via East Coast ports in proximity of the Appalachian region, according to IHS Markit.

Hurricane Harvey pointed out another advantage. The Appalachia region doesn’t get hurricanes like the Gulf Coast where refineries and petrochemical plants and the entire supply chain can be shut down for weeks after a major storm.

By Heather Doyle