Gulf coast refinery outages cut US capacity; Saudi Aramco buys 50% of Petronas complex

Our pick of the petrochemicals news you need to know.

Related Articles

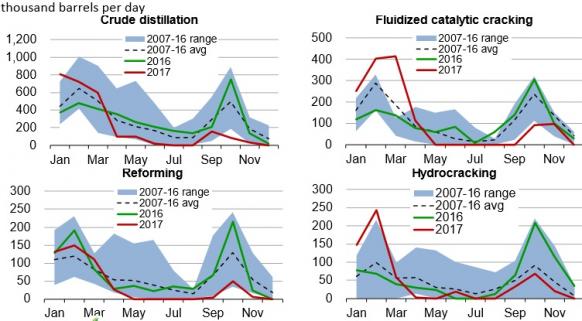

Gulf coast refinery outages in January-March dent production capacity

Gulf coast refinery output reductions will be above average in the first half of this year, mainly due to a higher-than-average number of planned outages in January-March, the US Energy Information Administration (EIA) said February 28.

Planned outages are expected to cut gasoline production capacity by 344,000 barrels per day (b/d) in February and March, while distillate fuel production capacity is expected to drop by 311,000 b/d in February and 246,000 b/d in March.

While the number of planned outages in the Gulf Coast region in the first half of 2017 are higher than average, regional inventories appear to be sufficient to offset lost production from those planned outages, EIA said.

"With Gulf Coast gasoline and jet fuel inventories at their highest level in 10 years, distillate inventories close to the 10-year average, and high levels of gasoline and distillate exports that could be diverted to domestic markets to offset reductions in refinery production, there are several options to make up for production losses due to planned refinery outages in the Gulf Coast," EIA said.

Over the first half of 2017, expected gasoline production reductions represent 27% of current inventory, jet fuel reductions represent 28% of current inventory, and distillate reductions represent 26% of existing inventory, EIA said.

Gulf Coast (PADD3) planned refinery capacity outages

Source: EIA (February 2017).

U.S. refineries have been running at near record-high levels, taking advantage of relatively low crude oil and natural gas prices, sophisticated upgrading equipment, and strategic supply locations for demand centers in Latin America.

Gross refinery inputs averaged 16.5 million b/d in January-November 2016, slightly exceeding 2015 which was itself the highest annual level since EIA began collecting data in 1985.

Refinery production of gasoline and distillate has increased to supply growing demand in global markets and this has helped widen the U.S.' petroleum product trade surplus.

Saudi Aramco to acquire 50% of Malaysian refining, downstream complex

The Saudi Arabian Oil Company (Saudi Aramco) is to take a 50% equity stake in the Refinery & Petrochemical Integrated Development (RAPID) facility being developed by Malaysia's Petronas, Saudi Aramco said in a statement February 28.

Saudi Aramco and Petronas executives signed a Share Purchase Agreement (SPA) for the equity acquisition during a state visit by Saudi Arabia's King Salman to Malaysia.

The RAPID refinery, cracker and downstream petrochemicals complex is part of the Pengerang Integrated Complex (PIC) which is situated 400 km south of Kuala Lumpur, Malaysia's capital. Construction of the whole facility is 60%-complete and the refinery is expected online in 2019.

The RAPID facility will have the capacity to refine 300 barrels of crude per day and will produce a range of petroleum products including gasoline and diesel. The facility will also produce feedstock for an integrated petrochemical complex which will produce 3.5 million tons per year (mtpa) of products.

"Upon the completion of the transaction, subject to regulatory approvals and the completion of other associated agreements, both partners will hold equal ownership in selected ventures and assets of the RAPID project within the Pengerang Integrated Complex (PIC)," Saudi Aramco said.

Other projects being developed on the PIC site include a cogeneration plant, an LNG re-gasification terminal, a raw water supply project and a deep-water terminal.

US natural gas exports to Canada rise 10.5% year-on-year

U.S. natural gas exports to Canada rose by 10.5% in 2016 to an average 2.1 billion cubic feet per day (Bcf/d), EIA said March 1.

Natural gas exports to Canada mainly originate from the U.S. states of Michigan and New York and are sent into eastern Canadian provinces. Rising production from the Marcellus and Utica shale formations has boosted output in the U.S. Northeast and expansions in pipeline capacity may lead to higher U.S. gas exports "over the next several years," EIA noted.

US monthly gas trade with Canada

Most of Canada's natural gas exports to the U.S. originate in Western Canada and are shipped to U.S. West, Midwest and Northeast markets.

Higher natural gas production from the Marcellus and Utica shale formations have reduced the U.S. Northeast's dependence on Western Canadian gas.

Canada is the U.S.' largest energy trading partner, mainly due to Canada's significant crude oil exports. Canada provided 41% of total U.S. crude oil imports in 2016 and sales of Canadian crude oil to the United States reached more than $83 billion in 2014, according to EIA.

Natural gas imports from Canada averaged 8.0 billion Bcf/d in 2016, representing 97% of all U.S. natural gas imports.

Total natural gas imports from Canada were valued at more than $5.9 billion in 2016, EIA said.

Braskem ships first U.S. ethane cargo to Brazil

Braskem exported its first cargo of U.S. ethane to Brazil late last month, from Enterprise Products' Morgan's Point export terminal in Texas, Platts reported.

The cargo was aboard the 9,133 mt Gaschem Arctic vessel, which departed from the Morgan's Point terminal on February 4 and was expected to arrive in Rio de Janeiro on February 23, according to the report.

The vessel was carrying around 78,000 barrels of ethane, a source reportedly told Platts.

In May 2016, Braskem announced it had signed a 10-year contract with Enterprise Products to supply ethane based on Mont Belvieu pricing.

Enterprise's 200,000 barrels per day Morgan's Point terminal came online in the fall of 2016.

Petrochemical Update