125 million electric cars to be on the road in next decade; Chemical industry must prepare for worst case weather

Our pick of the latest petrochemical news you need to know

125 million electric cars to be on the road in next decade

The number of electric cars on the road could reach 125 to 220 million globally by 2030 because of rising ambitions to meet climate goals and sustainability targets, according to a report released by the International Energy Agency (IEA).

The number of electric and plug-in hybrid cars on the world’s roads exceeded 3 million in 2017, a 54% increase compared with 2016, according to the latest edition of the IEA’s Global Electric Vehicles Outlook.

China remained the largest electric car market in the world, accounting for half sold last year. Nearly 580,000 electric cars were sold in China in 2017, a 72% increase from the previous year. The U.S. had the second-highest, with about 280,000 cars sold in 2017, up from 160,000 in 2016.

Electric mobility is not limited to cars.

In 2017, the stock of electric buses rose to 370,000 from 345,000 in 2016, and electric two-wheelers reached 250 million. The electrification of these modes of transport has been driven almost entirely by China, which accounts for more than 99% of both electric bus and two-wheeler stock, though registrations in Europe and India are also growing.

Charging infrastructure is also keeping pace. In 2017, the number of private chargers at homes and workplaces was estimated at almost 3 million worldwide. In addition, there were about 430,000 publicly accessible chargers worldwide in 2017, a quarter of which were fast chargers.

Fast chargers are especially important in densely populated cities and serve an essential role in boosting the appeal of electric vehicles by enabling long-distance travel.

The rapid uptake of electric vehicles has been helped by progress made to improve the performance and reduce the costs of lithium-ion batteries. However, further battery cost reductions and performance improvements are essential to improve the appeal of electric vehicles, the IEA said.

Innovations in battery chemistry will be needed to maintain growth as there are supply issues with core elements that make up lithium-ion batteries, such as nickel, lithium and cobalt. The supply of cobalt is particularly subject to risks as almost 60% of the global production of cobalt is currently concentrated in the Democratic Republic of Congo.

Additionally, the capacity to refine and process raw cobalt is highly concentrated, with China controlling 90% of refining capacity. Even accounting for ongoing developments in battery chemistry, cobalt demand for electric vehicles is expected to be between 10 and 25 times higher than current levels by 2030.

Growth for transportation fuels could plateau

U.S. refined product demand is at a cross roads as future light duty vehicle growth is focused on more efficient drive trains, an industry analyst told Petrochemical Update.

“The model for independent car ownership will switch to fleet owners which will push ownership of what regulators want, which is electric vehicles and hybrid electric vehicles,” said David Witte of IHS Markit

Witte was speaking at the Downstream 2018 conference and exhibition in Galveston, Texas.

“This will start in places like Europe and California from a regulatory standpoint and the penetration rate will start out slow and small,” he added.

However, the long-term impact will be demand for refined products will start to slow down.

“The overall growth for transportation fuels and gasoline is going to plateau and we are going to see car ownership switch.

This means that the market for refined products is going to slow down,” Witte explained.

Earlier this week, the U.S. Energy Information Administration (EIA) said that gasoline futures prices are below distillate futures prices, which is rare for this time of year.

During the spring and summer months, gasoline futures prices are generally higher than distillate futures prices by about 5 cents to 10 cents/gallon.

Not only is demand for gasoline in the U.S. higher in the spring and summer, but the gasoline sold in those months must be summer-grade gasoline, which is costlier to produce.

This year, however, gasoline futures prices have been lower than distillate futures prices in both April and May for the first time since 2013.

The front-month futures price of reformulated blendstock for oxygenate blending (RBOB, the petroleum component of gasoline used in many parts of the country) was on average 2 cents/gal lower than the front-month futures price of ultra-low sulfur diesel (ULSD) in April.

In May, the RBOB front-month price traded on average 3 cents/gal lower than the ULSD front-month price.

Although U.S. gasoline product supplied, and gross exports together are estimated to be about 2% higher so far this year compared with 2017,

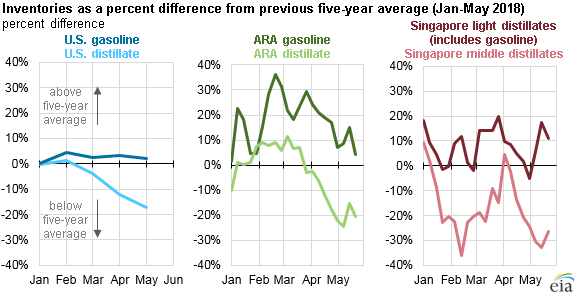

U.S. gasoline inventories have remained higher than their previous five-year averages for most of 2018.

Higher inventories have affected gasoline’s value relative to distillate and gasoline’s value relative to crude oil, which is known as the crack spread.

The RBOB-Brent crude oil crack spread averaged 34 cents/gal in April and 35 cents/gal in May. The last time the RBOB-Brent crude oil crack spread was lower for either month was in 2012.

Other regions in the world have also seen higher levels of gasoline inventories and, as a result, are experiencing lower gasoline crack spreads.

Major trading hubs in northwest Europe and Singapore had gasoline inventory levels higher than their previous five-year averages for most of 2018 and have had lower gasoline crack spreads compared with recent years in April and May, according to the EIA.

Chemical industry must prepare for worst case weather scenario – CSB

The U.S. Chemical Safety Board (CSB) urged the chemical industry to be prepared for worst case scenarios at their facilities considering that extreme weather events are likely to increase in number and severity.

The Atlantic hurricane season is a time when most tropical cyclones are expected to develop across the northern Atlantic Ocean. It is currently defined as the time frame from June 1 through November 30.

The CSB released its final report on a chemical fire at the Arkema plant in Crosby, Texas, during Hurricane Harvey in August and September 2017.

Arkema plant in Crosby, Texas flooded after Hurricane Harvey

Federal investigators said that while there was a plan in place at the Arkema plant during Hurricane Harvey, company officials did not prepare for the catastrophic nature of the flooding that happened.

“Our investigation found that there is a significant lack of guidance in planning for flooding or other severe weather events.

Based on other government reports, we know that there is a greater likelihood of more severe weather across the country. As we prepare for this year’s hurricane season, it is critical that industry better understand the safety hazards posed by extreme weather events,” CSB Chairperson Vanessa Allen Sutherland said.

In the days leading up to the incident at Arkema, an unprecedented amount of rain fell at the plant due to Hurricane Harvey, causing equipment to flood and fail. As a result, chemicals stored at the plant decomposed and burned, releasing fumes and smoke into the air.

The Arkema chemical plant manufactures and distributes organic peroxides, many of which must be kept below 32 degrees Fahrenheit to prevent them from decomposing and catching fire. Under normal operation, the organic peroxides are stored in low temperature warehouses and shipped in refrigerated trailers.

Extensive flooding caused by heavy rainfall from Hurricane Harvey caused the plant to lose power and backup power to all the low temperature warehouses.

Workers at the Arkema facility moved the organic peroxides from the warehouses to the refrigerated trailers, which were then relocated to a high elevation area of the plant.

Three of those trailers, however, were unable to be moved and eventually flooded and failed. With refrigeration on those trailers lost, there was nothing to stop the chemicals inside from heating up and catching fire

All Arkema’s employees were evacuated from the facility and more than 200 residents living nearby the facility were evacuated and could not return home for a week. 21 people sought medical attention from exposures to the fumes and smoke released into the air.

In its final report, the CSB called for more robust industry guidance to help hazardous chemical facilities better prepare for extreme weather events, like flooding, so that similar incidents can be avoided.